Community Eco-Credit pilot - incentive for local marine management and opportunity for livelihoods improvement

In partnership with Mwambao-MCCC and GreenFi we began working on a Community Eco-Credit scheme we named "MKUBA".

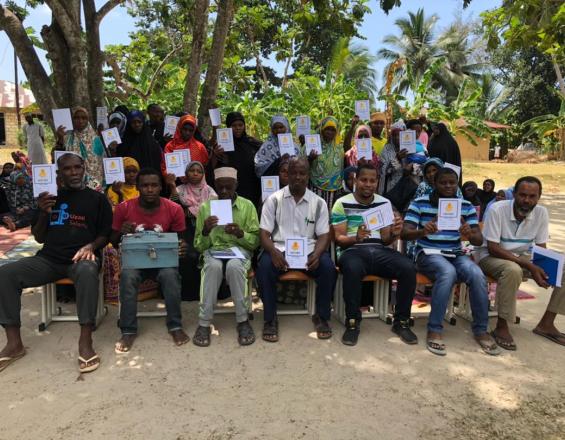

2.5 years since inception, a review of the model has revealed interesting first results and shed light on areas requiring attention. Many aspects are already truly encouraging. A grant to the community has allowed for nearly 370 community-managed loans for 213 individual beneficiaries in 5 groups with over 50% of women, for a total loan value of over USD 27,000. The original grant capital of USD 4,000 has grown to USD 5,000 via an Islamic finance approach. Repayments are near 100%.

Loans can be used for household improvements or income generation compatible with community marine resources plan. Each loan comes with a self-determined environmental commitment and as a result, legal fishing gears have been adhered to, 20,000 mangrove propagules have been planted and patrols and security of closed areas have significantly increased. In 2021 the MKUBA is now being implemented in 3 more communities in Zanzibar.

Context

Challenges addressed

-

Insufficient capacity and resources.

- The lack of diversification opportunities is also often hindered by the difficulty to access any form of credit and a generally limited literacy in conducting small businesses.

- Late repayments during 2020 (as a result of additional stresses related to the Covid-19 pandemic and from a lack of regular project follow-up), but has been overcome in 2021

Location

Process

Summary of the process

- Local management planning provides the basis on which the eco-credit groups will base their “environmental compliance” conditions for their members to access the loans. Members of the groups will need to respect these conditions, thus boosting compliance and implementation of the local management plan.

- The MKUBA/eco-credit groups established should be key subsets representing different parts, different sub-community groups for the population of a considered community (e.g. of a ward comprising several villages, or of a large village). For instance, if the management plan is focusing on managing an octopus fishery locally, it is key to have at least one eco-credit group that is formed of community members engaged into octopus fishing.

- Monitoring the financial, environmental and social indicators of the activity will help track how the eco-credit groups and their members are doing financially and socially and how the link between the loans and the environmental management actions (management plan) is holding.

Building Blocks

Community-level ecosystem management institution (active and regularly engaging with the community the community they represent)

The Ward Fisheries Committee (WFC) is in Zanzibar the community institution responsible for local marine resources management. But they have often been weak: with little capacity and effectiveness.

The Eco-credit pilot was embedded in a wider project aiming to build a more effective co-management framework with strengthened WFCs.

Without a wider ongoing project in which an eco-credit scheme is nested, it would still be key to have an active community institution in charge of local natural resources management in some way, to link loans access to environmental conditions agreed by the community.

The community-level marine management plan sets priorities and objectives to manage natural resources. It is created by the WFC, facilitated by the project team if applicable. The plan can then serve as guidance for the environmental compliance and actions to be undertaken by the eco-credit groups’ members.

The local management plan can be started simple and focus on a few conservation/management targets with matching by-laws to enforce, and be further elaborated while the eco-credit scheme is running. In such cases the active participation of the broadest possible base of community members (especially those members of the eco-credit groups) is very important.

Enabling factors

-

The legal and actual existence of recognised and active community institutions in charge of the local marine and coastal resource management.

-

Provisions in national legal framework for fisheries and marine conservation enabling communities to locally implement management actions (and enforce them).

-

Experience and support from the relevant authorities regarding the process to approve/formalise the by-laws decided by the responsible community institution.

Lesson learned

- Where collaborative management for fisheries is new, it is imperative that fishery authorities do not feel threatened by the process and fully understand the benefits.

-

Sensitive facilitation during the process is important.

-

Roles and responsibilities of committee members should be clearly understood to aid in the election of the most appropriate persons to key positions.

-

Building capacity for conflict resolution is very important especially in a previously open access fishery or where regulations or enforcement have been absent or are very low.

Eco-credit/MKUBA groups (formed and trained to issue loans to their member and track their repayment)

MKUBA stands for Mfuko wa Kutunza Bahari: “Fund to care for the sea” in Kiswahili. It is a type of Community Eco-Credit scheme.

Community eco-credit is defined as: “credit, managed at the community level, conditional on ecological actions undertaken by the community member borrower required under the loan terms.” (Wild, et al, 2020) – will send ref is there space for it.

In our MKUBA pilot five groups, constituted according to the main livelihood activity of their members, have been initially established in 2018; they were made of foot fishers, net fishers, seaweed farmers, mangrove users, and the last group were the member of the WFCs.

The eco-credit group members attended a series of training to enable the group to operate and follow the rules they have to abide by to receive the capital funding from the supporting organisation. Trainings included the following main topics: Leadership training, Record keeping, How to protect the cash box, By-laws of each group, Fines, Capacity building in business (brief), Conservation management and reporting procedures.

Enabling factors

-

A clear and relatively well-respected local management plan or by-laws (or one that is not subject to acute conflicts), that is therefore quite easy to translate into compliance conditions of access for the loans by the eco-credit groups’ members.

-

Previous local experience, in the supporting organisation(s) and/or in the communities benefitting, of formal or informal community credit handling loans cycles and revolving funds

-

A generally good mutual trust across the members of the groups to be established.

Lesson learned

- Eventual drop-outs from the eco-credit groups should be regularly and closely monitored.

-

If drop-outs signal a common problem it should be investigated and addressed quickly, particularly to avoid spreading further and endangering the whole scheme.

-

Duty of care: it is important for the project to operate a duty of care when encouraging individuals to do business, and to avoid encouraging inexperienced people to take on risky businesses.

Monitoring system for repayments and environmental compliance (established and operational)

As with any conservation and development project, it is essential to monitor the activity and the impact. From the outset, monitoring in the MKUBA pilot has been constantly improved, with strong support with Mwambao-MCCC, GreenFi and the pilot community itself. The main components can be divided into the main three following fields:

-

Financial monitoring:To ensure that borrowers stay on track regarding their loan repayment schedule, and avoid any delay/knock-on to the rest of the eco-credit group, to ensure the eco-credit groups operate smoothly as planned/trained for, to detect and address any issues that may arise in the loans life-cycle in the eco-credit groups

-

Social/economic monitoring: To understand the social dynamic around the scheme, to understand what the loans are used for (it can be for productive purposes or livelihoods conditions ones, such as emergency needs, school fees, etc.), to ensure that the loans don’t lead into any over indebtedness

-

Environmental monitoring: To track the impact on compliance to local rules, and evaluate how it acts as an incentive boosting local management, to ensure that borrowers are not putting more pressure on other natural resources to repay their loans.

Enabling factors

-

Some existing literacy in the groups to keep records

-

A pre-existing Monitoring & Evaluation system in the supporting organisations piloting the scheme, with flexible data management and related capacity to adapt, to be able to reflect and react timely.

-

An expert/dedicated support organisation (such as GreenFi) to help via: providing tools to make monitoring smoother and simpler, this can involve applications or other technological solutions.

Lesson learned

-

Data recorders need a thorough understanding of the data to be collected and of the importance of correct recordings. For instance, people’s exact names and ages, as well as the time spent fishing are important so that fishing effort can be calculated.

-

Each of the first groups were issued with a tablet to record some data. This has not proved to be particularly functional - smartphones worked better in his case. The first version of the mobile app was difficult to implement properly.

-

There have been some business failures notably for instance on chicken breeding, and a milkfish small aquaculture project that eventually looked non-operational. Those did not seem based on proven technical feasibility or any existing skills by their initiators.

Impacts

- A high degree of satisfaction has been reported among the majority of participants, with community requesting to roll out more MKUBA groups and neighbouring communities expressing willingness to replicate the scheme.

- This degree of satisfaction provides the community with a tangible link between locally-led coastal and marine resource management, within Pemba Channel Conservation Area and the improvement of residents’ livelihoods

- Strengthened local management plan implementation, with MKUBA groups’ participating in community patrols (additional to those piloted by the fishers’ committee), 20,000 mangrove propagules have been planted since inception.

Beneficiaries

-

Community members grouped into livelihoods groups to access loans.

-

Net fishers, seaweed farmers, mangrove users, Village Fishers Committee.

-

Wider community members.

-

Conservation area managers (including ministry, district authorities' staff).

-

Mwambao-MCCC.

Sustainable Development Goals

Story

My name is Tabia. I'm 43 years-old, married with 9 children and live in the coastal village of Kukuu, in the South of Pemba Island, Zanzibar. Many women like me in Pemba know about and have been part of HISA groups (Household Income and Savings Associations, based on the Village Savings and Loans Associations’ model promoted by Care International), before I joined one of the first MKUBA groups gathering seaweed farmers.

Seaweed farming is conducted mainly by women in Zanzibar. I am one of them but I am also a local collecting agent, selling dried seaweed to the companies buying in the archipelago. Besides seaweed, I also farm in my family’s plantations (e.g. bananas). I used my MKUBA loans to start a small kitchenware shop.

My first MKUBA loan of ~USD 130 together with another from my HISA group allowed me to secure some funding from the government and have enough invest in setting up my new shop. My regular income from seaweed farming and trading enabled me to repay my first MKUBA loan in 3 months, and to take another one to diversify my shop’s products.

This shop has really increased my overall revenue and provide for my family and 9 children. I believe multiplying sources of income is what all MKUBA group members should aim for, it is important to not depend too much on only one or two activities, especially those related to fishing or farming for instance, whose yields have generally not been increasing in the last years. But people joining a MKUBA group and borrowing need to also make sure they have enough regular income to repay their loan without putting them in too much stress.

Besides borrowing, being in a group gave me access to a few basic small business trainings facilitated by Mwambao and peer support from the members of the group. Now I feel much more capable of being a successful shop owner and I’m helping other women to find their own way and to conduct positive local actions for our environment, such as restoring our mangroves.

Caring for our nature is very important: if we destroy or harm coral reefs, mangroves and seagrasses too much, then more people suffer in the village with less or smaller octopus or even not good seaweed production. This MKUBA opportunity in Kukuu has helped show that even with small loans we can start other activities and take less from the sea to allow some time for fishes to come back. Even those not currently borrowing are now more interested in local management and see that is possible.