Framework of Governance for Metropolitan Areas and Economic Agglomerations

Possessing the nation’s largest economic engine, best assets, and living services, Tokyo Metropolitan Government (TMG) exercises its huge monetary power to allocate public resources, redistribute economic benefits, and stabilize dynamic markets in a distinctive manner. With the large budget that reached JPY 13.658 trillion for FY 2016, the fiscal structure of TMG may not be comparable to any other local governments in Japan but includes many important implications for the governance of emerging megacities and for financial challenges in other countries.

Context

Challenges addressed

TMG’s revenue stream is sensitive to market conditions due to its high dependency on corporate-related taxes (i.e., Metropolitan Inhabitant Tax on Corporations and Business Tax on Corporations), accounting for 34.7 % of the Metropolitan Tax revenue. In fact, the revenue sharply dropped – more than JPY 1 trillion - after the global financial crisis in 2008. Also, TMG's expenditure on urban capital investments is larger than other local governments, which are spent on urban infrastructure such as roads and bridges, schools, and social welfare facilities.

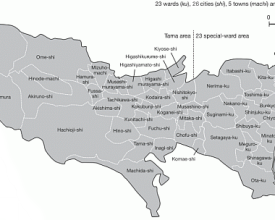

Location

Process

Summary of the process

Over the next few decades, a number of megacities are predicted to emerge in the Asia Pacific region. However, the development and management of those emerging megacities now call for the expansion of institutional capacity ahead of growth for urban improvement and fiscal sustainability. In case of TMG, the government sustains high degree of fiscal self-reliance without many subsidies from the national government. With the large corporate-related tax revenue, TMG spends a high percentage of expenditure on capital investments compared to other local governments. However, this type of expenditure is more affected by macroeconomic cycles and policy swing. Under unstable economic circumstances, earmarked taxes enable the TMG to keep stable and multiple-year resources for large-scale capital projects.

Building Blocks

High Degree of Fiscal Self-reliance

TMG’s large general account budget is relatively self-reliant without many subsidies from the national government. This is due to affluent revenue gained through local taxes (or “Metropolitan Tax”). The Metropolitan Tax accounted for 74.3% of the total revenue of TMG in FY2016. This proportion is considerably higher than that of all other local governments (45.1%). In contrast, the percentages of national treasury disbursements and local bonds are much lower than those in other local governments. Additionally, TMG is the only prefectural government that does not receive intergovernmental grants (i.e., local allocation tax) through the national tax redistribution system.

Enabling factors

- Large corporate-related tax revenue from one of the world’s largest business agglomerations.

Lesson learned

Fiscal structures of economically powerful cities are by and large self-reliant due mainly to a large amount of corporate-related tax revenue. However, more public spending is expected to overcome social difficulties and create economic opportunities. An aging society will require huge government expenditures on social welfare programs in the coming decades. Policymakers must also consider the urgent issue of disaster prevention, which requires huge capital reinvestment.

Large Expenditure on Urban Capital Investments

The unique features of TMG’s expenditure profile compared to all other local governments are found to be more capital investment and the existence of an adjustment cost that contributes to fiscal balance among the 23 special wards. Capital investments are spent on urban infrastructure such as roads and bridges, schools, and social welfare facilities. TMG continued to invest in large-scale public facilities as part of the economic stimulus despite the sharp drop in tax revenues after the crash of Japan’s bubble economy during the 1990s. Consequently, it faced a serious financial crisis. The government made concerted effort to reduce expenditure under a fiscal reform scheme for about a decade. Once the fiscal balance was recovered, construction-related expenditure has continued to increase over the last decade.

Enabling factors

-

Political decisions of the local government on large scale capital investments

-

Growing urban population of TMG and the surrounding area

Lesson learned

In cities highly depending on corporate-related tax revenue for its finance, the public urban capital investment is sensitively affected by macroeconomic cycles and political swings. Moreover, there is growing fiscal pressure for massive renovation of old infrastructure over the coming decades in developed cities. Hence, it is vital to incorporate the idea of “life-cycle asset management” into local government fiscal management practices.

Earmarked Taxes for Urban Improvement

Under unstable economic circumstances, earmarked taxes enable the TMG to keep stable and multiple-year resources for large-scale capital projects. Among more than 13 kinds of local taxes, two are earmarked for urban capital improvements. City planning tax, which accounts for 4.7% of the total revenue, is levied on land parcels and properties in the urban development promotion areas and collected together with Fixed Assets Tax (property tax). The revenue is specified to use for urban development and land readjustment programs. Another earmarked tax for urban capital improvements is Establishment Tax, which accounts for 2.1% of the total revenue. This tax is levied on offices with large floor areas and/or with a large number of employees in the 23 special wards and four cities of Tokyo. The revenue is to be used specifically for improving urban business environments.

Enabling factors

- Application of earmarked taxes for urban capital improvements

Lesson learned

Large cities tend to rely heavily on corporate-related tax revenues, although they are basically market-sensitive sources. To secure stable fund resources for urban development programs over a certain period regardless of economic circumstances, the application of earmarked taxes for urban capital improvements could be a useful approach. However, an item-fixed budgeting approach is likely to discourage flexible resource allocation across projects and programs, and could result in by “organizational sectionalism”. Therefore, it is essential to find a variety of revenue sources and establish a well-balanced fiscal structure, according to the socio-economic nature of a city.

Impacts

Tokyo is the nation’s political and economic core and boasts an abundant supply of Grade-A business office buildings, major transportation facilities, and regional public services. Despite the fact that Japan’s entire population is gradually shrinking, the residential inflow into Tokyo and the surrounding jurisdictions, including Kanagawa, Saitama, and Chiba prefectures, continues to grow.

Beneficiaries

- Residents of Tokyo Metropolitan Area

- Private entities in Tokyo Metropolitan Area