Marco de gobernanza para áreas metropolitanas y aglomeraciones económicas

El Gobierno Metropolitano de Tokio (TMG), que cuenta con el mayor motor económico del país, los mejores activos y servicios de vida, ejerce su enorme poder monetario para asignar recursos públicos, redistribuir beneficios económicos y estabilizar mercados dinámicos de una manera distintiva. Con un presupuesto de 13,658 billones de yenes para el año fiscal 2016, la estructura fiscal del TMG puede no ser comparable a la de otros gobiernos locales de Japón, pero tiene muchas implicaciones importantes para la gobernanza de las megaciudades emergentes y para los retos financieros de otros países.

Contexto

Défis à relever

El flujo de ingresos de TMG es sensible a las condiciones del mercado debido a su gran dependencia de los impuestos relacionados con las empresas (es decir, el Impuesto Metropolitano de Habitantes de Sociedades y el Impuesto de Actividades Económicas de Sociedades), que representan el 34,7 % de los ingresos del Impuesto Metropolitano. De hecho, los ingresos se redujeron drásticamente -más de 1 billón de yenes- tras la crisis financiera mundial de 2008. Además, el gasto de TMG en inversiones de capital urbano es mayor que el de otros gobiernos locales, que se destina a infraestructuras urbanas como carreteras y puentes, escuelas e instalaciones de bienestar social.

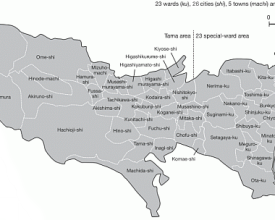

Ubicación

Procesar

Resumen del proceso

Se prevé que en las próximas décadas surjan varias megaciudades en la región de Asia-Pacífico. Sin embargo, el desarrollo y la gestión de esas megaciudades emergentes exigen ahora la ampliación de la capacidad institucional por delante del crecimiento para la mejora urbana y la sostenibilidad fiscal. En el caso de los TMG, el gobierno mantiene un alto grado de autosuficiencia fiscal sin muchas subvenciones del gobierno nacional. Gracias a los elevados ingresos fiscales relacionados con las empresas, TMG destina un alto porcentaje de gasto a inversiones de capital en comparación con otros gobiernos locales. Sin embargo, este tipo de gasto se ve más afectado por los ciclos macroeconómicos y el vaivén de las políticas. En circunstancias económicas inestables, los impuestos asignados permiten al TMG mantener recursos estables y plurianuales para proyectos de capital a gran escala.

Bloques de construcción

Alto grado de autonomía fiscal

El abultado presupuesto de la cuenta general de TMG es relativamente autosuficiente, sin muchas subvenciones del gobierno nacional. Esto se debe a los ingresos obtenidos a través de los impuestos locales (o "Impuesto Metropolitano"). El Impuesto Metropolitano representó el 74,3% de los ingresos totales de TMG en el ejercicio 2016. Esta proporción es considerablemente superior a la de todos los demás gobiernos locales (45,1%). En cambio, los porcentajes de los desembolsos del Tesoro nacional y de los bonos locales son muy inferiores a los de otros gobiernos locales. Además, TMG es el único gobierno prefectural que no recibe subvenciones intergubernamentales (es decir, impuesto de asignación local) a través del sistema nacional de redistribución de impuestos.

Factores facilitadores

- Importantes ingresos fiscales procedentes de una de las mayores aglomeraciones empresariales del mundo.

Lección aprendida

Las estructuras fiscales de las ciudades económicamente poderosas son, en general, autosuficientes debido principalmente a la gran cantidad de ingresos fiscales relacionados con las empresas. Sin embargo, se espera un mayor gasto público para superar las dificultades sociales y crear oportunidades económicas. Una sociedad que envejece exigirá enormes gastos públicos en programas de bienestar social en las próximas décadas. Los responsables políticos también deben tener en cuenta la urgente cuestión de la prevención de catástrofes, que requiere enormes reinversiones de capital.

Grandes gastos en inversiones de capital urbano

Las características únicas del perfil de gasto de TMG en comparación con todos los demás gobiernos locales son una mayor inversión de capital y la existencia de un coste de ajuste que contribuye al equilibrio fiscal entre los 23 distritos especiales. Las inversiones de capital se destinan a infraestructuras urbanas como carreteras y puentes, escuelas e instalaciones de bienestar social. El TMG siguió invirtiendo en instalaciones públicas a gran escala como parte del estímulo económico a pesar de la fuerte caída de los ingresos fiscales tras el desplome de la economía de burbuja de Japón durante la década de 1990. En consecuencia, se enfrentó a una grave crisis financiera. El gobierno hizo un esfuerzo concertado para reducir el gasto en el marco de un plan de reforma fiscal durante aproximadamente una década. Una vez recuperado el equilibrio fiscal, el gasto relacionado con la construcción ha seguido aumentando en la última década.

Factores facilitadores

-

Decisiones políticas del gobierno local sobre inversiones de capital a gran escala

-

Creciente población urbana de TMG y alrededores

Lección aprendida

En las ciudades cuya financiación depende en gran medida de los ingresos fiscales relacionados con las empresas, la inversión pública en capital urbano se ve sensiblemente afectada por los ciclos macroeconómicos y los vaivenes políticos. Además, en las ciudades desarrolladas existe una creciente presión fiscal para la renovación masiva de infraestructuras antiguas en las próximas décadas. De ahí que sea vital incorporar la idea de "gestión de activos a lo largo del ciclo de vida" a las prácticas de gestión fiscal de los gobiernos locales.

Impuestos destinados a mejoras urbanas

En circunstancias económicas inestables, los impuestos asignados permiten al TMG mantener recursos estables y plurianuales para proyectos de capital a gran escala. Entre los más de 13 tipos de impuestos locales, dos se destinan a mejoras de capital urbano. El impuesto de urbanismo, que representa el 4,7% de los ingresos totales, grava las parcelas y propiedades de las zonas de promoción del desarrollo urbano y se recauda junto con el Impuesto sobre Activos Fijos (impuesto sobre bienes inmuebles). Los ingresos se destinan específicamente a programas de desarrollo urbano y reajuste de tierras. Otro impuesto destinado a mejoras de capital urbano es el Impuesto de Establecimiento, que representa el 2,1% de los ingresos totales. Este impuesto grava las oficinas con grandes superficies y/o con un gran número de empleados en los 23 distritos especiales y las cuatro ciudades de Tokio. Los ingresos se destinan específicamente a mejorar el entorno empresarial urbano.

Factores facilitadores

- Aplicación de impuestos asignados a mejoras de capital urbano

Lección aprendida

Las grandes ciudades tienden a depender en gran medida de los ingresos fiscales relacionados con las empresas, aunque son fuentes básicamente sensibles al mercado. Para garantizar unos recursos de fondos estables para programas de desarrollo urbano durante un periodo determinado, independientemente de las circunstancias económicas, la aplicación de impuestos asignados a mejoras de capital urbano podría ser un planteamiento útil. Sin embargo, es probable que un enfoque presupuestario basado en partidas fijas desincentive la asignación flexible de recursos entre proyectos y programas, y podría dar lugar a un "seccionalismo organizativo". Por lo tanto, es esencial encontrar diversas fuentes de ingresos y establecer una estructura fiscal equilibrada, acorde con la naturaleza socioeconómica de una ciudad.

Impactos

Tokio es el núcleo político y económico de la nación y cuenta con una abundante oferta de edificios de oficinas de negocios de categoría A, importantes instalaciones de transporte y servicios públicos regionales. A pesar de que toda la población de Japón está disminuyendo gradualmente, la afluencia residencial a Tokio y las jurisdicciones circundantes, incluidas las prefecturas de Kanagawa, Saitama y Chiba, sigue creciendo.

Beneficiarios

- Residentes del Área Metropolitana de Tokio

- Entidades privadas del Área Metropolitana de Tokio