Conservation credit unit (CCU) marketing

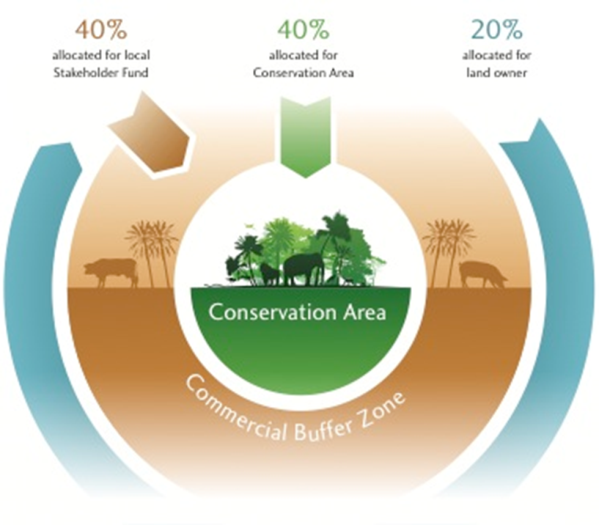

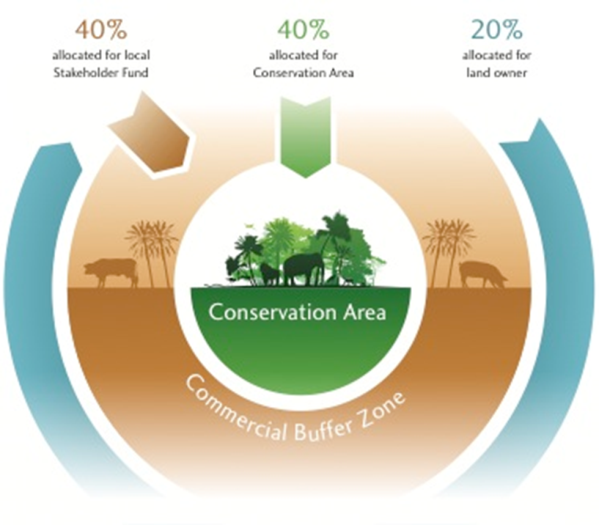

Fig. 2: Distribution of benefits from CCUs

The fund administrator, NGO FUNDECODES, and other brokers promote CCUs to investors, who buy them for at least ten years. CCU returns are distributed for use across the different zones of the project area: 40% for conservation activities in the core area, 40% for sustainable production activities in the commercial buffer zone and 20% for the owners of the credit-generating land.

- Conservation agreement between FUNDECODES and the Global Conservation Standard (GCS)

- Current legislation allows conservation credits to be valued and sold

- Institutional stakeholders which are committed to work with the private sector and civil society

- Private sector willing to voluntarily offset

- Brokerage: Bringing together demand and offer, e.g. buyers and sellers of CCUs

- Stakeholders are empowered by the financing scheme because they receive financial support to implement conservation activities and are involved in decision-making and prioritization.

- The project is recognized as a model by conservation authorities because it implements an environmental sustainability standard with support from strong partners.

- There is high interest among Costa Rican private sector to compensate CO2.

- International investors are interested in due diligence and full accountability when buying CCUs. This is guaranteed by GCS using independent accredited bodies to carry out annual assessments of carbon stocks, maintaining objectivity, accuracy and transparency and offering real-time GIS imagery.

- There is still a need to improve the capacity of FUNDECODES and SINAC in marketing, brokerage, establishment of the MRV-System and adequate management of the “Small Project Funds”.