Biodiversity Tax Incentives For South Africa's Protected Area Network

South Africa identified protected area expansion as a key tool to ensuring the persistence of its biodiversity and ecosystems essential for its people and economy. Approximately 75% of South Africa is held in private ownership. Landowners bear the responsibility of managing protected areas and face financial commitments as a result. The Fiscal Benefits Project was launched to test biodiversity tax incentives as a financial benefit for landowners declaring protected areas. This began with the introduction of a new tax incentive into legislation. The impact of the incentive was tested at pilot sites across the country, resulting in the successful inclusion of the tax break in a tax return. This has paved the way for other privately owned protected areas to receive financial recognition and ensure the continued governance and management of South Africa’s protected areas, utilising building blocks of policy and grassroots engagement, niche expertise and a supportive community of practice.

Context

Challenges addressed

South Africa’s first biodiversity tax incentive provides financial sustainability for privately and communally owned protected areas, allowing for the continued and often costly governance and effective management of important sites. By providing financial sustainability that is linked to protected area management, the challenge of poorly managed protected areas ineffectively stopping habitat and biodiversity loss is addressed. Better management also supports the health and provision of ecosystem services. Landowners and businesses benefit economically and socially as tax breaks reduce the amount of tax owed, freeing up much needed cash flow, in turn ensuring continued commercial viability of activities compatible with protected areas, such as eco-tourism and cattle ranching. Effective and sustained protected areas also support sustainable livelihoods, development of the rural economy, and ensure the long term persistence of protected areas in landscapes competing for resources.

Location

Process

Summary of the process

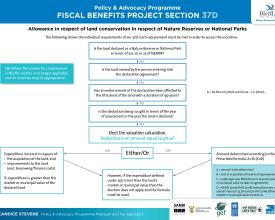

Successfully introducing South Africa’s first biodiversity tax incentive was a complex process requiring support from numerous stakeholders, including government, protected area implementers, landowners and communities. The process also required concrete testing to determine the impact of the incentives and their tangible benefit on the ground. Due to the nature of the finance solution being tax related, niche tax skills were required to implement the solution, at a policy level, and during grassroots testing. These needs and processes illustrate how the solution’s four building blocks: national policy engagement, grassroots engagement, a cohesive community of practice, and niche tax skills, worked together to achieve this unique success. The policy engagement enacted a legislative amendment that introduced the new tax incentive, which could then be tested with landowners and communities at a grassroots level to determine its effectiveness. This testing would not have been possible without the involvement of a collaborative community of practice. These engagements required a tax specialist due to the nature of the niche expertise required for implementation, which combined with the other building blocks, created a winning formula.

Building Blocks

National Policy Engagement

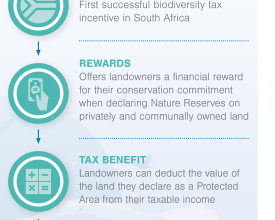

The success of introducing South Africa's first biodiversity tax incentive into the protected areas network began with the amendment of South Africa's Income Tax Act. Without the tax incentive being lodged into national fiscal legislation, the solution would never have been possible. This first successful step required the building block of: National Policy Engagement. Amending the Income Tax Act required deliberate engagement with key national ministries and departments, primarily: the Department of Environmental Affairs and the Ministry of Finance. Institutional support was provided by the Department of Environmental Affairs and the department endorsed the tax work at a national level. This allowed for direct engagement with key environmental fiscal policy makers within South Africa's National Treasury. This engagement was direct, open, collaborative and positive, and allowed for the formulation of South Africa's first tax deduction aimed at supporting and benefitting taxpayers formally protecting South Africa's natural heritage in the public interest.

Enabling factors

- The success of this building block was due in part to the historically positive relationships between national ministries and conservationists, which the Project was able to leverage.

- Additionally, the project manager is a tax specialist; without these niche tax skills the national policy engagement would not have been as successful.

- Policy makers also understood two key points: the country’s environmental need and the use of protected areas, and the need to fiscally reward land stewards for their public benefit investment.

Lesson learned

Key lessons learned in successfully engaging with national policy makers:

- The use of niche skill sets: when aiming to introduce specific tax incentives, a tax specialist was required to effectively discuss this with national tax policy makers.

- Deliberate and direct communication: regular, professional, and accurate information and Project updates ensured that communication enhanced the policy engagement and expectations were met.

- Networking and relationship building: ensuring project implementers knew, and were known, by policy makers allowed for the Project’s goals to not be forgotten and allowed for personal communication and messaging.

- Institutional support: having institutional support from key government departments was crucial to securing the support from other government departments and policy makers.

- Historical relationships: understanding the history behind previous engagements, positive and negative, was vital in determining how the policy engagement proceeded.

Resources

Grassroots Project Engagement

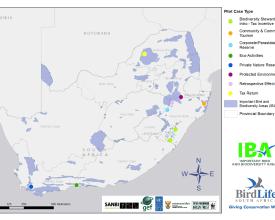

The Project launched a number of pilot sites across the country to test the use and applicability of biodiversity tax incentives in different contexts. The pilot sites enabled the Project to engage with the people directly impacted by the tax benefits. The pilot sites covered parastatals, international companies, communities, and individual farmers undertaking different commercial activities. The sites also covered different biomes and biodiversity priority areas. This grassroots engagement was a crucial building block as it took the policy engagement of the Project, as well as the achievement of amending national legislation, and practically tested its impact on the ground. To determine what impact the tax incentives would have on landowners declaring protected areas, landowners themselves needed to be engaged deliberately. This grassroots engagement effectively illustrated the financial and tangible benefits of the incentive. These pilot sites also showed that the new biodiversity tax incentive was applicable to all types of legal entities in South Africa and could be applied to a varied array of commercial and private enterprises and activities. It effectively applied the tax impact to landowners and showed that it was successful and replicable.

Enabling factors

- The primary enabling factor was willing landowners and communities. Without their voluntary engagement, the practical application of the biodiversity tax incentives would not have been possible.

- The community of practice assisted in facilitating introductions to landowners and communities and allowed relationships to be built on existing engagements.

- A further factor was clear communication about the tax incentives and the fact that they were being tested; expectations were mitigated and the challenges were outlined from the onset.

Lesson learned

Key lessons learned in implementing the Grassroots Project Engagement:

- Working with an existing community of practice: voluntary participation was needed for this Project. Working within an existing community of practice allowed for relationships to be forged, and more deliberate engagement to be undertaken based on relationships that were already established. Having to start this process from scratch takes time, and in this case, the Project was under timeline and policy pressures.

- Clear and honest communication: again, voluntary participation from grassroots stakeholders was required to determine the Project aims. Clear and honest communication was delivered from the onset of the Project with the aim of mitigating expectations and not making false promises. The challenges and nature of the pilot sites was outlined from the very first engagement and this proved successful throughout the pilot phase of the Project.

Community of Practice

Introducing South Africa’s first biodiversity tax incentive required the support and assistance of a very effective and cohesive community of practice within South Africa’s national biodiversity stewardship initiative. The tax incentives relate directly to South Africa's protected areas declared on private or communally owned land. This context required the support of the implementers of these types of protected area declarations to facilitate this unique biodiversity finance solution. The implementers of biodiversity stewardship in South Africa range from representatives of national and provincial government, NGOs, and various experts and specialists. They work together in a collaborative community of practice which provided its full support to the tax incentive work. The novelty of the tax work, as well as the numerous components of the Project that required simultaneous success, required the direct support, advice and assistance of the community of practice. This support facilitated Building Blocks 1 and 2 and ensured that the Project deliverables could be achieved in the most conducive environment possible.

Enabling factors

- The nature of South Africa’s biodiversity stewardship community of practice was the enabling factor of this building block. The community of practice, into which the work on biodiversity tax incentives was placed, is by nature collaborative, communicative, and cohesive. This allowed for the tax work, despite its uniqueness and complexity, to be supported and assisted by key members of the community of practice. The community of practice is constituted in this way due to the individual experts who work within this field.

Lesson learned

Key lessons learned in utilising the community of practice building block:

- Team work: attempting to introduce South Africa’s first biodiversity tax incentive in isolation would have been an error. The tax incentives had to be introduced into the context of biodiversity stewardship in South Africa. The Project was integrated into this community of practice during its scoping phase and throughout its implementation.

- Partnerships: From the inception of the Project, key partnerships were sought. These partnerships, their support, skills, advice, and varied expertise, were vital to the successful implementation of this complex undertaking.

- Regular feedback: the Project provided regular feedback to the community of practice, key partnerships, and stakeholders throughout its duration. This regular feedback allowed for the dissemination of information. Additionally, it allowed for collaborators to remain invested in the Project’s success and ensured continued support.

Specialist Skills: Niche Tax Expertise

The nature of this Project sought to create a biodiversity finance solution for South Africa's protected areas that was built on tax law. In order to succeed in this venture, it was central to have a tax specialist undertake the Project. Previous attempts to introduce biodiversity tax incentives in South Africa had failed due to incorrect tax structuring and lack of practical tax testing. In both the amendment of national tax legislation, as well as the actual appropriation of the tax incentives on behalf of landowners, a skilled tax practitioner, who understood both detailed tax law as well as the environmental policy and legislation that the tax incentives linked to, was required. The very unique nature of this work required a niche skill set to ensure its effective and efficient implementation. This biodiversity finance solution could not have been introduced without a tax specialist.

Enabling factors

The use of niche tax skills was enabled through catalytic funding secured to employ such skills to undertake this Project.

Lesson learned

Key lessons learned from the niche skill set building block include:

- Cross-sector bridges: attracting different skill sets into the mainstream conservation sector was a catalytic step in being able to introduce this innovative solution for biodiversity conservation.

- Thinking outside of the box: the utilisation of a skill set uncommon in conservation, created an out-of-the-box solution;

- Niche expertise are vital to achieve specific and intricate deliverables: the use of a very specific skills set and expertise regarding tax law was vital to achieving this innovation. The idea was insufficient and key skills were required for successful implementation.

Impacts

South Africa’s first biodiversity tax incentive provides financial sustainability for privately/communally owned protected areas allowing for the continued governance and effective management of important sites which require continual and often costly management. The project benefits landowners and businesses economically and socially by providing tax breaks that reduce the amount of tax owed. Freeing up much needed cash flow, ensuring continued commercial viability for activities compatible with protected areas, such as eco-tourism and cattle ranching. The use of biodiversity tax incentives in protected areas is recognised as one of the UNDP’s BIOFIN Solutions for South Africa. It is estimated to contribute close to 10% additional finance in closing South Africa’s biodiversity finance gap. Despite protected areas featuring as a key conservation tool by the South African Government, there are limited resources and capacity in the public and private sectors where conservation funding remains an urgent priority. The inclusion of a successful tax break into South Africa’s protected area network is providing much needed biodiversity finance for the sustainable persistence of well governed and effectively managed protected areas.

Beneficiaries

Beneficiaries of the biodiversity tax incentives include private and communal landowners willing to declare and manage protected areas, these range from individual farmers to multiple stakeholder communities to corporates and parastatals.

Sustainable Development Goals

Story

South Africa is recognised as one of the world’s 17 mega-diverse countries. Protected areas, declared on state, private or communal land are key to safeguarding South Africa’s incredible biodiversity and the functioning of ecological infrastructure essential to the benefit of its people and its developing economy.

Expanding, governing and managing protected areas is a costly undertaking and limited resources and capacity, as well as other socio-economic constraints, hinder these processes. South Africa’s privately and communally owned protected areas play a vital role in addressing some of these challenges. However, landowners willing to make the ultimate conservation commitment, in formally recognising and managing protected areas on their land, require assistance either through conservation services and relationships or financial benefits, such as South Africa’s first biodiversity tax incentive: Section 37D.

In one of South Africa’s Key Biodiversity Areas, full of endemic plants, Big Five game, and scenic diversity, one such landowner took the plunge and declared a Nature Reserve in perpetuity. Kaingo Private Game Reserve is an effectively managed protected area and a successful tourism operation, creating jobs and stimulating the rural economy of the area. The creation and management of this beautiful reserve and its eco-tourism operations is no small feat.

As a result of this landowner’s commitment to conservation, Kaingo has received the Section 37D tax break. Due to the extensive investment in the tourism venture and the management of a big game area, the tangible financial benefit of this innovative tax incentive is bolstering the reserve’s cash flow, ensuring the continued success of this protected area. By paying less tax, additional resources can be mobilized so that Kaingo can be better managed and governed and continue to grow, benefiting both South Africa’s biodiversity and its economy. Without effective management protected areas fail to achieve what they were created for, and without viable and sustainable business operations to support management costs, such as Kaingo, effective management is no longer feasible.

It is a priority to provide valuable and alternative sources for financing biodiversity conservation, and rewarding individuals and organisations willing to undertake the safeguarding of our natural heritage, if we are to see the continued persistence of wildlife and beautiful landscapes in South Africa.

www.kaingo.co.za